The next Bitcoin halving is just around the corner, which will have significant impact on not just the Bitcoin price but the cryptocurrency industry as a whole. We detail everything you need do know about the Bitcoin halving date and the wider impact of

the upcoming halving event.

What is a Bitcoin halving?

Bitcoin relies on blockchain technology to securely function. As part of this, Bitcoin mining refers to the distributed consensus system that confirms pending transactions by including them in the blockchain in chronological order. Transactions are subject

to strict cryptographic rules, which are verified by the system, as they are packed in blocks to be added to the chain. This ensures security of the network because it’s not possible to modify previous blocks without invalidating the entire chain of subsequent

blocks.

The halving policy was written into Bitcoin’s mining algorithm in an attempt to counteract inflation by maintaining scarcity. The Bitcoin code dictates that the reward for miners is reduced by half after every 210,000 blocks are created, which is the event

we call a Bitcoin halving. As long as demand for Bitcoin remains the same, the Bitcoin halving, in theory, will lead to an increase in price.

Bitcoin halving date

Blocks of transactions are added approximately every 10 minutes, which means that the Bitcoin halving cycle is roughly four years. The next Bitcoin halving is due to occur in 2024, with current date estimates and Bitcoin halving countdowns estimating the

exact date to be April 17th, 2024.

How many Bitcoin halvings have there been?

Bitcoin was the first cryptocurrency created and was officially launched in January of 2009. Since then, there have been three historical Bitcoin halvings which have reduced the reward for miners. The initial reward in 2009 was 50 BTC, which would be worth

over £1,000,000 today. At the moment, pre-2024 halving, the mining reward stands at 6.25BTC, which is approximately £224,693.

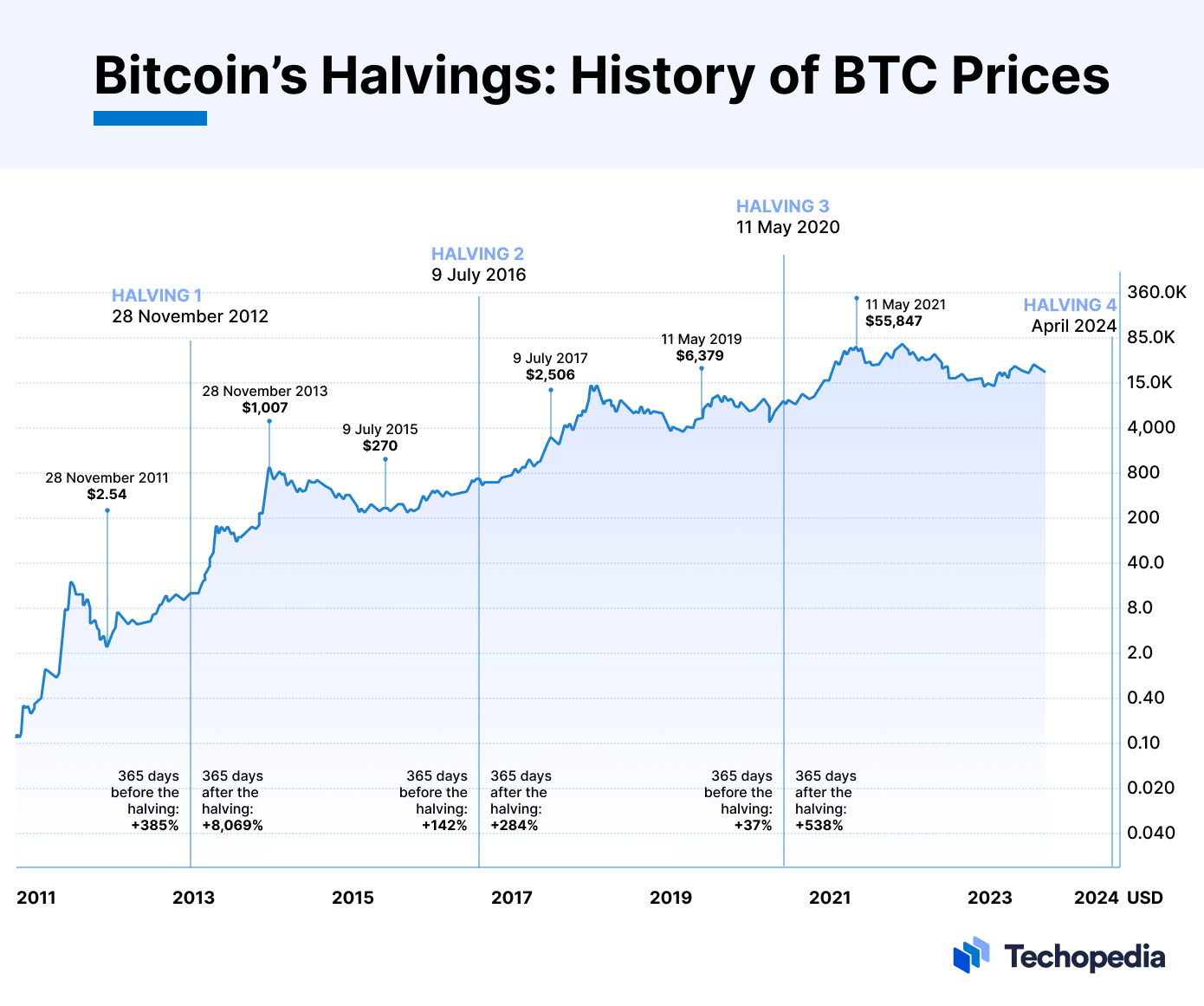

Bitcoin halving price chart:

Source:

Forbes

Source:

Techopedia

2024 Bitcoin halving price prediction

After the 2024 halving, the reward for miners will stand at 3.125 BTC. Designed to maintain scarcity, Bitcoin halvings generally led to an increase in Bitcoin prices.

“Historically, there is a lot of Bitcoin price volatility leading up to and after a halving event. However, the price of Bitcoin typically ends up significantly higher a few months after,”

comments Rob Chang, CEO of Gryphon Digital Mining.

While the first halving in 2012 did not have a significant impact on Bitcoin prices due to the cryptocurrency’s infancy, the second halving in 2016 led to a 194% increase in Bitcoin prices, and the

third having in 2020 increased prices by 100%.

Market uncertainty in 2023, combined with the shockwaves caused by the collapse of the cryptocurrency platform FTX, make

it harder to predict the impact the 2024 Bitcoin halving will have on price. While experts remain cautiously optimistic about a 2024

rebound in crypto investment, the upcoming halving is not a guaranteed catalysts for prices as Bitcoin remain a high-risk asset in a current environment of economic uncertainty.

What happens when there is no Bitcoin left to mine?

From the get-go, there has been a limit of how many bitcoins will be mined. The maximum number of bitcoins is 21 million, and once that number is reached, no new bitcoins will be issued. Current estimates show that we are likely to reach the 21 million in

2140.

Once there is no Bitcoin left to mine, miners will no longer receive block rewards and will instead have to rely on transaction fees for compensation. It is likely that once this point is reached, Bitcoin will become deflationary as coins can be lost through

human error, i.e., if a user sends Bitcoin to an invalid address.